From TMQ: http://sports.espn.go.com/espn/page2/story?page=easterbrook/081021

Dispensation for Compensation: One of the reasons some Wall Street types and CEOs are absurdly overpaid -- as AIG was losing $4.9 billion in the fourth quarter of 2007, CEO Robert Willumstad received a $5 million bonus for the quarter; imagine how much Willumstad would have gotten if AIG had lost even more -- is the word "compensation." You and I receive "pay." Bankers and executives insist on calling the sums they pocket "compensation," as if they weren't in it for the money, but are merely being compensated for lofty service. Calling executives' pay "compensation" also suggests that people at the top of organizations are higher beings, not just more important, but worthier than the rabble beneath them. George Orwell was right when he contended that the words we use can alter our ability to think clearly; letting CEOs and bankers get away with calling their paychecks "compensation" causes us to view them as high-and-mighty Olympians, rather than as employees of shareholders.

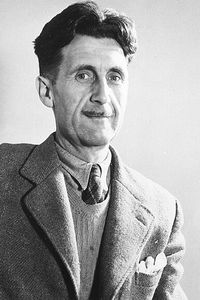

AP Photo

The phrase "executive compensation?" He would call it Orwellian.

Politicians and the media go along with the "compensation" conceit. When Lehman Brothers CEO Richard Fuld Jr. was being grilled by the House Committee on Oversight last week about the $480 million he awarded himself from 2000 till the company's 2008 ruin, members of Congress repeatedly called this sum Fuld's "compensation," as if he were a great humanitarian just back from public service work among remote Amazonian tribes. Journalists are supposed to call things what they are, not what they claim to be, yet the media constantly use the misleading euphemism "compensation." Here's two things from last week's New York Times: "At its peak, Goldman Sachs gave away $16.5 billion in compensation," while the latest corporate bailout plan specifies that "executives who are compensated based on company performance that is later found to be inaccurate will have to forfeit that compensation." I wasn't caught engaging in stock fraud, your honor, I just forfeited compensation!

What bankers and Wall Street figures receive is "pay." Pay should be called what it is. Since it is perfectly legitimate to receive pay, why won't high-corporate types use this word? To be paid $45 million for one year -- Fuld's actual number for 2007, when the company was careening toward wiping out its investors -- sounds obscene. Receiving $45 million in compensation -- well, it's only compensation, right?

In true private enterprise, not taxpayer-subsidized concerns such as what AIG has become, high pay is justified if executives perform. The elite investment banking houses worked on the assumption that 40 percent should go to management as bonuses. If management brings in $10 billion and keeps 40 percent, that's better for shareholders than if management brought in $5 billion and kept 20 percent. The problem is that management awards itself vast sums regardless of performance. For example, in 2007, Citigroup's profits fell 83 percent, but executive bonuses went down only 5 percent. Here are details of how AIG, shortly before the bailout, gave its CEO a $20 million golden parachute even as shareholders were about to be wiped out, while awarding $34 million in bonuses to AIG executive Joseph Cassano -- whose division had just lost $25 billion.

AP Photo/The Charlotte Observer

We're supposed to subsidize bankers making $750,000 a year?

Last week, financial giant USB, which is struggling to stay above water and expected to succeed, limited senior executives to $750,000 per year until losses end. That's a start, anyway. From a New York Times story about the decision: "That is still an extraordinary amount of money, but given the costs built into bankers' lives -- mortgages, private school and so on -- the money can quickly run out." Wait, bankers have trouble paying their mortgages on $750,000 per year? Prices are high in Manhattan, but it's ridiculous for the Times to express concern for executives forced to get by on $750,000 a year. Bear in mind, your tax dollars are now subsidizing this lifestyle for the banking elite. And where is it written that bankers' children must attend private schools? Congress refuses to enact a living minimum wage of $10 a hour, but couldn't wait to underwrite the Sag Harbor weekend homes and private schools of bankers.

0 comments:

Post a Comment